New Amendments to the Special Tax in Jordan: Reductions on Gasoline Cars and Increases on Electric Vehicles

1 year ago

The Jordanian Council of Ministers has approved an amendment to the Special Tax Law for the year 2024. The amendment includes a reduction in the tax on gasoline-powered vehicles, while gradually increasing the tax on higher-priced electric vehicles.

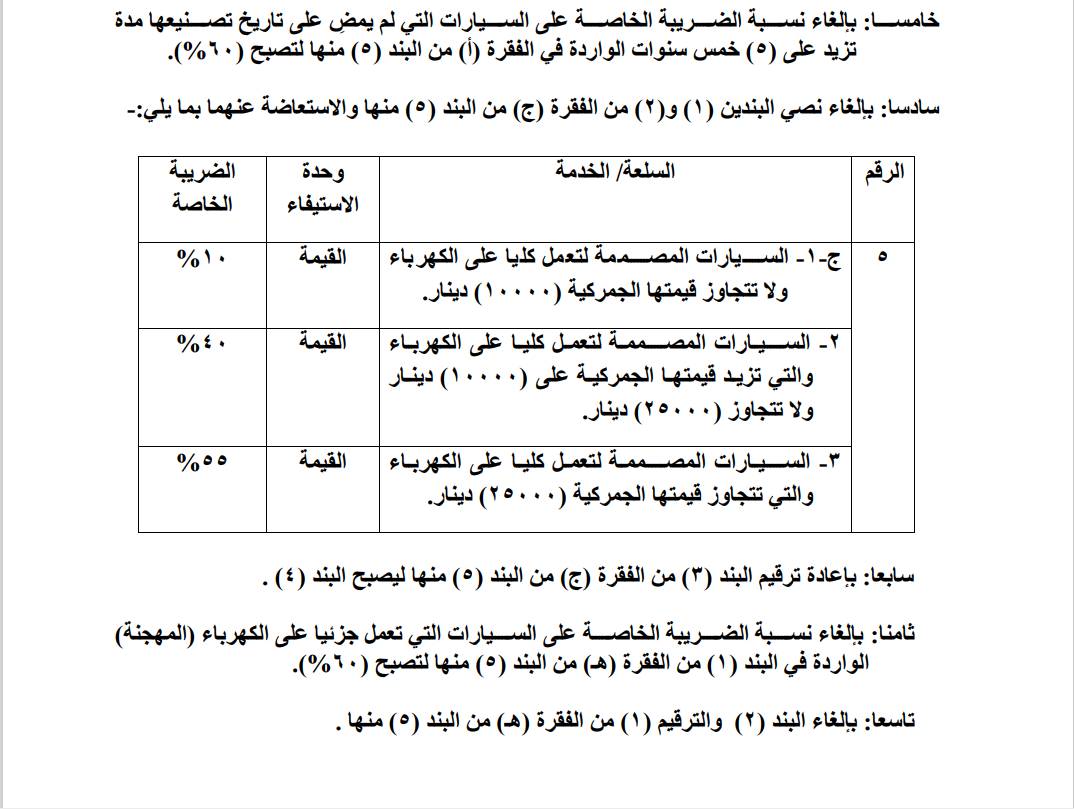

Under the new amendment, the special tax rate on electric vehicles is determined based on their value. Electric vehicles valued at 10,000 JD or less will be subject to a 10% special tax. Vehicles valued between 10,000 - 25,000 JD will be taxed at a rate of 40%, while those exceeding 25,000 JD will be subject to a 55% tax.

This amendment aims to narrow the gap between the taxes imposed on electric vehicles and those on conventional fuel-powered vehicles, while maintaining a lower tax rate on electric vehicles compared to gasoline or diesel-powered alternatives. The goal is to encourage the use of electric vehicles while achieving a balanced tax structure across different vehicle categories.

The government clarified that electric vehicles valued at less than 10,000 JD will not be affected by the amendment, and the tax rate will remain at 10%.

As for gasoline-powered vehicles, the tax reduction will apply only to those that are less than five years old.

HOMEPAGE.RELATED_ARTICLES

COMMON.SEE_ALL