Chinese Brands BYD and Nio Lead Car Sales in China with Remarkable Growth in August 2024

1 year ago

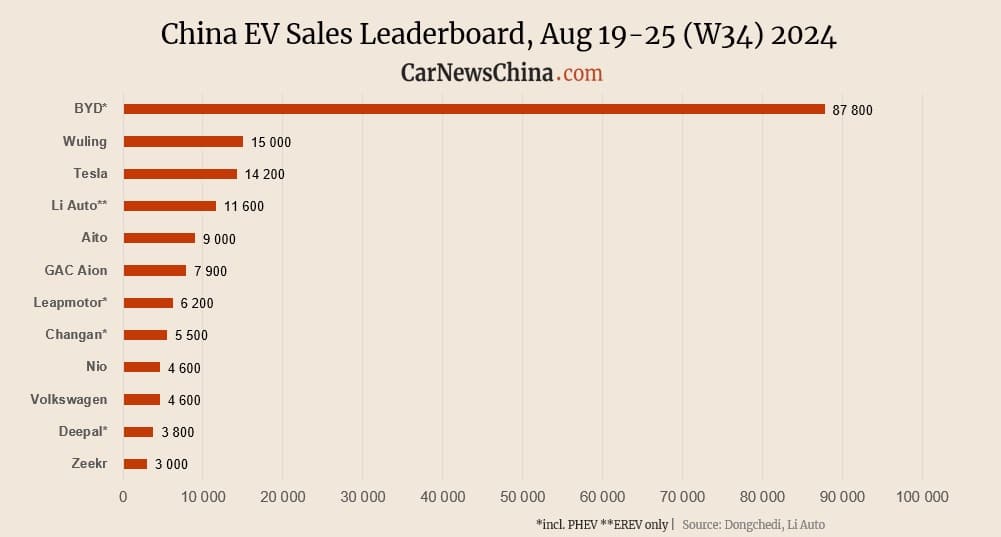

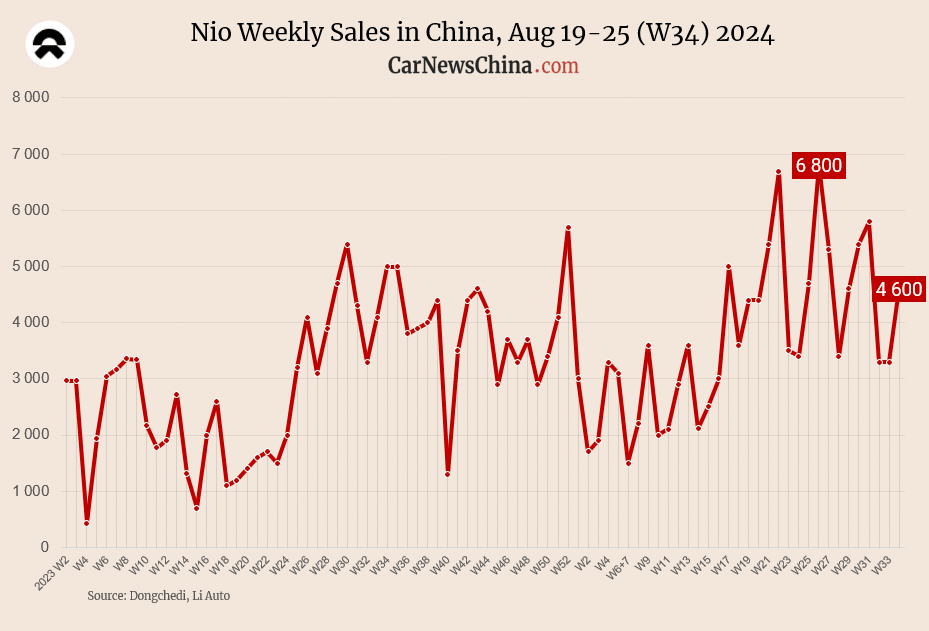

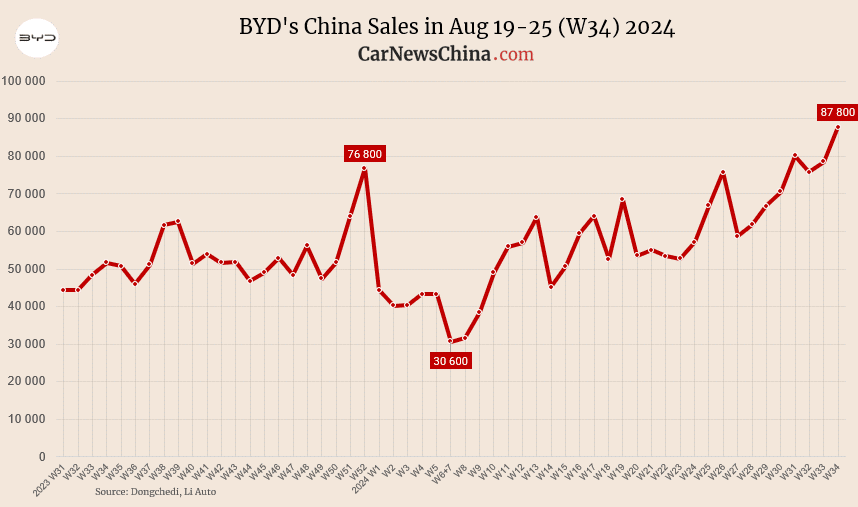

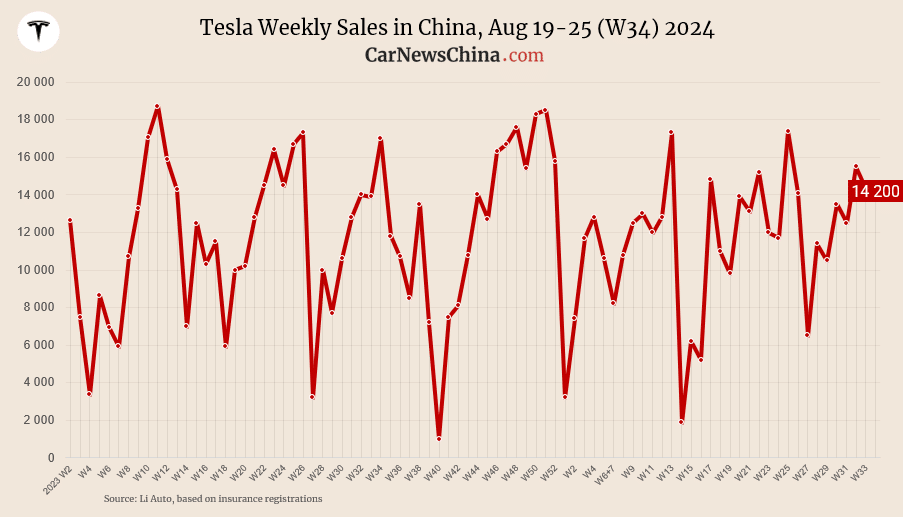

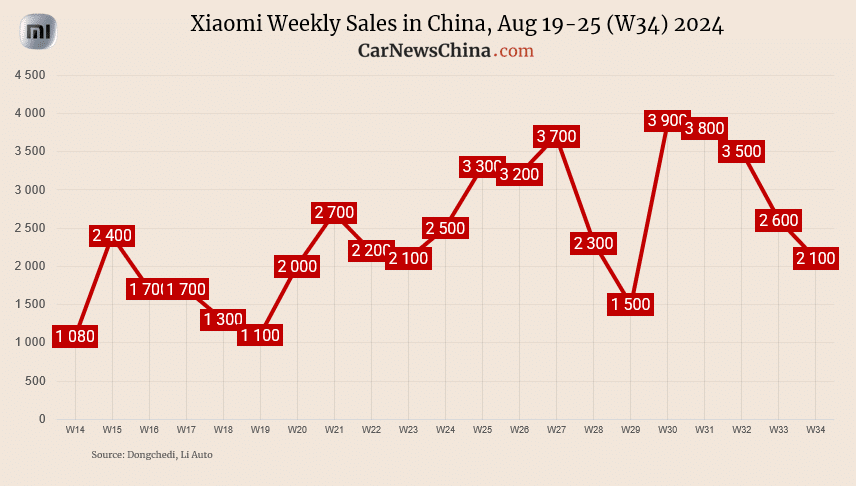

In the third week of August, specifically in the 34th week of 2024 (August 19-25), the Chinese automotive market experienced a strong upward trend, with the exceptions of Zeekr and Xiaomi. Nio reported a significant 40% increase in insurance registrations, while BYD's registrations rose by 10% compared to the previous week. On the other hand, Tesla's numbers remained relatively stable, while Xiaomi saw a significant decline of 20%.

Market Overview and Growth of New Energy Vehicles (NEVs)

During this period, China's electric vehicle market continued its steady growth, with the penetration rate of new energy vehicles (NEVs) exceeding 50% again, reaching 51.61%. These vehicles include battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and extended range electric vehicles (EREVs). The total vehicle sales for the week amounted to 467,000 units, representing a slight 0.43% decline compared to the previous year but a notable increase of 13.08% from the previous week.

Sales of internal combustion engine (ICE) vehicles reached 226,000 units, marking a 24.41% decrease compared to the previous year, although they rose by 14.72% from the previous week. In contrast, NEV sales reached 241,000 units, reflecting a 45.18% increase compared to the previous year and an 11.57% rise from the prior week. For the year-to-date performance, the Chinese automotive market achieved total sales of 13.053 million units, indicating a growth of 3.22% compared to the previous year. NEV sales alone contributed 5.71 million units, showing a significant increase of 39.09% compared to the same period in 2023. The year-to-date NEV penetration rate rose to 43.74%, up by 11.28 percentage points from last year.

Brand Performance Highlights

BYD led the market with a record registration of 87,800 vehicles for the week, an increase of 11.85% from the previous week and a substantial 69.83% rise compared to the same period last year. Between August 5 and 25, BYD sold a total of 242,100 vehicles in China.

SGMW, a joint venture of General Motors in China under the Wuling brand, recorded sales of 15,000 electric vehicles, an 18.11% increase from the previous week and a 92.31% year-over-year jump. Tesla followed, registering 14,200 vehicles, a slight decrease of 0.7% from the previous week and a 16.47% decline from the previous year. Tesla's total sales in the first three weeks of August amounted to 44,000 vehicles.

Relevant: New Tax Decisions Threaten Chinese Car Sales in Europe

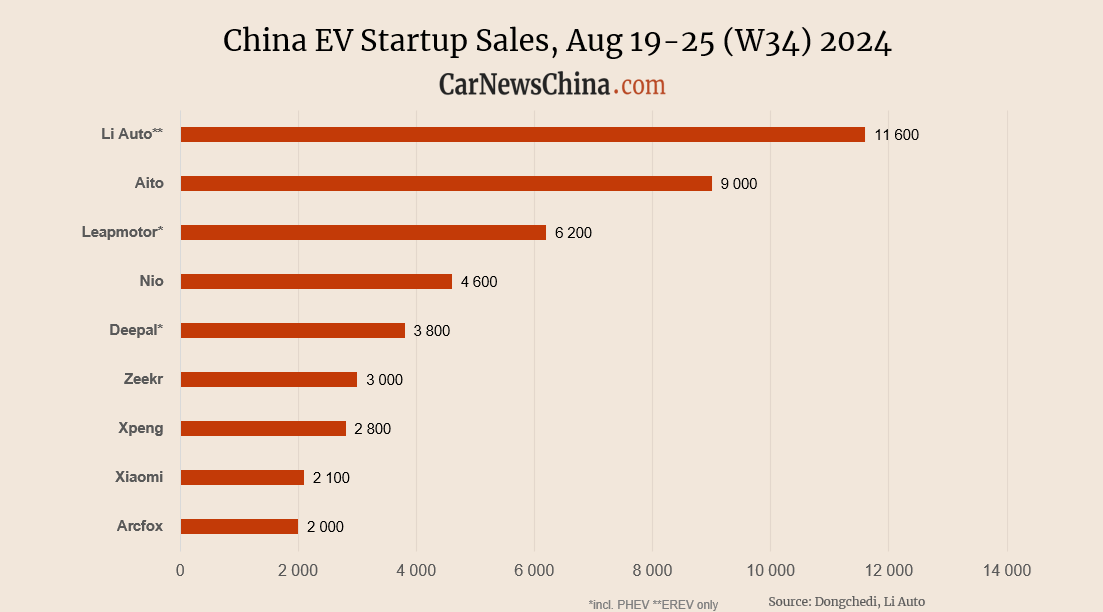

Li Auto demonstrated steady growth, selling 11,600 vehicles, an 8.41% increase from the previous week and a 50.65% year-over-year rise. Meanwhile, Aito experienced the most significant increase, with a 60.71% week-over-week rise, selling 9,000 vehicles and an astonishing 1025% growth compared to the same period last year.

Other Notable Performances

GAC Aion saw a 14.49% week-over-week increase, selling 7,900 vehicles, although this represented a 36.29% decline from last year. Leapmotor doubled its sales year-over-year to 6,200 units, while Changan's sales rose slightly by 5.77% week-over-week to 5,500 units. Nio recorded a significant 39.39% increase from the previous week, selling 4,600 vehicles, although this was an 8% drop from the same period last year.

Volkswagen's sales increased by 21.05% from the previous week to 4,600 units, despite a slight 6.12% year-over-year decline. Deepal sold 3,800 vehicles, reflecting a 22.58% weekly growth and a 31.03% year-over-year increase. Zeekr's sales decreased by 14.29% from the previous week to 3,000 units, a slight drop from last year.

Xpeng saw a 21.74% week-over-week increase in sales to 2,800 vehicles, although it faced a 15.15% decline year-over-year. Xiaomi's sales dropped by 19.23% to 2,100 vehicles, while Denza reported a slight increase of 5.88% from the previous week, selling 1,800 units, although this represented a 21.74% decline compared to the previous year.

Overall, the Chinese NEV market is experiencing dynamic growth, with many brands showing significant increases in sales and market penetration, reflecting a broader shift towards electric mobility in China.

HOMEPAGE.RELATED_ARTICLES

COMMON.SEE_ALL